What Are Closing Costs for New Construction?

Table of Content

- Cost of Special Home Inspections in Fremont, OH

- Which? Money podcast: where should you be putting your money?

- Ask the seller to cover some of your closing costs

- States With the Highest Total Fees as a Percentage of the Sales Price

- Closing Costs Explained: What Are Closing Costs and How Much Are They?

- Transfer taxes or recording fees

- Tax Monitoring And Tax Status Research Fees

Transfer taxes go to your local government in exchange for updating your home’s title and transferring it to you. Like most types of other local taxes, this fee will vary depending on where you live. Many lenders require you to pay for a year’s worth of homeowners insurance at closing. As a general rule, expect to pay about $35 a month for every $100,000 in home value. Breakdown of seller concessions limits for conventional loans. The percentage shown is based on the purchase price or appraised value, whichever is lower.

Home inspections are typically paid in-person and are not included as part of your closing costs. Inspections typically cost between $300–$500, which varies based on the property and your local rates. There are several closing costs and fees that affect buyers in Texas. Although the Texas market can be flexible with some of these costs, it helps to be knowledgeable about each of them to get your best deal and even save you precious time. According to a 2020 research study by The Ascent, the average closing cost in Texas is $3,744 for a home priced at $274,163, which is 1.37% of the home sale price. In addition, Texas doesn't have any taxes or fees on real estate transfers.

Cost of Special Home Inspections in Fremont, OH

Don’t be afraid to take some time to shop around for lenders. If you buy a home without an agent, remember to write into your offer letter that you’re proposing a lower rate in exchange for no agent commission. If it’s a refinance from a different type of loan into a VA loan, the funding fee is 2.3% if it’s your first use and 3.6% for a subsequent use. You may pay more if you’re buying a very large property or one with unusual boundary lines.

These costs average about $5,000, according to Freddie Mac, and include credit report fees, origination fees, appraisal fees, and recording costs. In a home sale, seller closing costs are taxes and fees the seller pays to finalize the transaction and transfer ownership of the property to the buyer. When finalizing a property sale, both buyers and sellers owe a number of closing costs. For sellers, closing costs can add up to 8–10% of the home sale price — on top of repaying any debts or liens related to a property. Some depend on the state in which you’re buying your home, others on the county.

Which? Money podcast: where should you be putting your money?

Check the interest rates, monthly payments, and upfront costs on each offer to find the best overall deal for you. The amount you’ll pay in home equity loan fees can vary a lot from one lender to the next. So the best way to save money is by comparing offers from a few different lenders to find the cheapest one. In most areas, you will pay an earnest money deposit when you reach mutual acceptance on your home purchase. The amount you pay in earnest money will be subtracted from your closing costs — reducing the total amount you owe at closing. Your personal finances aren’t the only consideration that affects the mortgage refinance rates you’re offered.

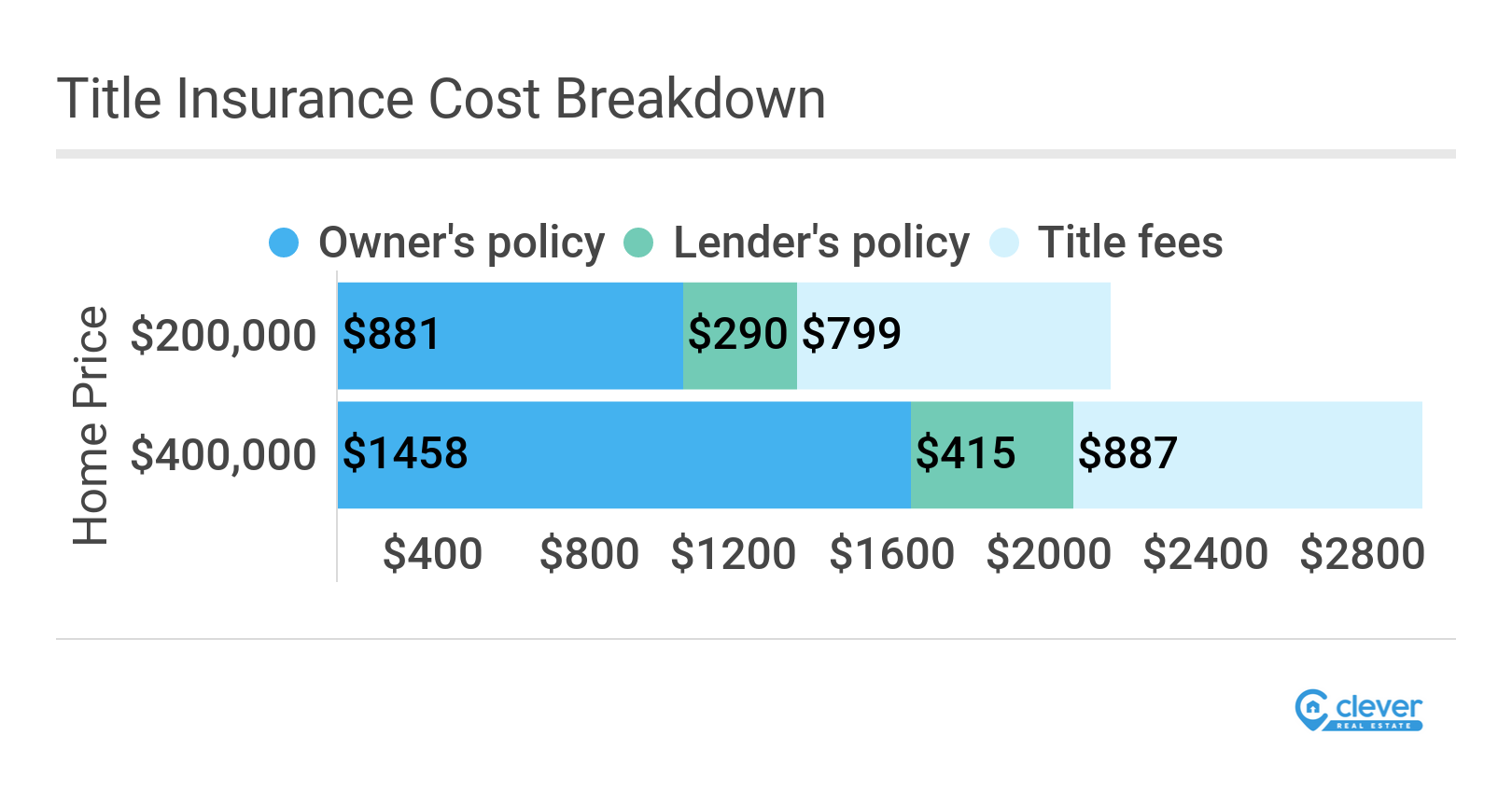

Typically, they are 2-5% of your loan amount for the home purchase and refinance loans. Mortgage lenders will almost always require you to purchase a lender’s title insurance. It protects them against loss over potential defects in the title or legal claims over the house. The lender’s title insurance must cover the full amount of the loan. If you are opting for an FHA loan, you have to pay an upfront premium and an additional annual fee. The amount of these payments is based on the size of the loan.

Ask the seller to cover some of your closing costs

Some costs are lender requirements, some are government requirements and others may be optional, depending on the situation. What you’ll need to pay for will depend on where you live, your specific lender and what type of loan you take. VA loan seller concessions follow a couple of different rules depending on what they’re being applied to. Up to 4% of the purchase price or appraised value can go toward escrow accounts and any required VA funding fee. Typically optional for buyers, owner’s title insurance protects you from future claims against the title.

Our budget breakdowns will help you better understand the Maldives trip cost you might be expecting. We’ve chosen a standard five-night trip for each budget breakdown, highlighting Maldives resorts that fit within each budget category. For a six-day, five-night trip to the Maldives, you can plan to spend anywhere from $567 all the way to $30,900 for a stay in a standard room. This is a big range – and it does not take into account your airfare from home to the Maldives.

States With the Highest Total Fees as a Percentage of the Sales Price

It’s similar to a title search, but is paid as its own line item. This covers collecting your credit report from all three credit bureaus. Oklahoma residents are eligible for the federal Clean Energy Credit for a 30% tax credit towards purchasing a solar system. But Oklahoma does not currently have a state incentive or rebate program specifically for solar energy. Subscriptions, such as Arcadia, to power their homes with solar energy. Roof condition Your roof may need repair before solar panel installation.

If you don’t pay this way, you might escrow the taxes, which means they would be included as an escrow line item in your monthly mortgage payment to your loan servicer. As a buyer, you can request that the seller pay for some or all of your closing costs while negotiating the offer. According to the Zillow Group Consumer Housing Trends Report 2020, 85% of sellers make some kind of trade-off with the buyer to facilitate the sale of a home. This is a beneficial strategy if you don’t have enough cash available after paying your down payment to cover closing costs, too. It’s most commonly used when there are many sellers competing for a small pool of buyers.

Depending on the market conditions, you can negotiate the deal with the seller by requesting them to cover some of the closing costs for buyers or offer credits towards closing costs. In fact, if the seller is selling their house as is, you can leverage that by asking them to cover your share of the closing costs. Tassone says the best chance buyers have to lower their closing costs is to ask for lender credits, which are not tied to whether it’s a buyer’s or seller’s market. These fees directly impact the lender’s bottom line, so it depends on how much the lender needs your business. There’s a slew of down payment assistance programs available for eligible buyers, including grants, matched savings accounts and low-interest loans.

The biggest fee you’ll pay is real estate commission — at 5–6% of the sale price, realtor fees account for more than half of your estimated seller closing costs. Sometimes referred to as reserve fees or prepaids, escrow funds hold reserved money for property taxes, premiums, homeowners insurance and mortgage insurance. The lender then uses the escrow funds to make payments on your behalf as part of your regular mortgage payment.

Business expert Michael Soon Lee, Ph.D., is an internationally recognized speaker and consultant whose clients include Coca-Cola, Chevron, Boeing, State Farm Insurance and General Motors. His articles have appeared in newspapers and magazines such as The Wall Street Journal, the San Francisco Chronicle, the Los Angeles Times and Consumer Reports. He was dean of the School of Management at John F. Kennedy University and served as an adjunct faculty member for Golden Gate University for over 20 years. Title insurance is an insurance policy that protects the lender’s interest in the home in case of any problems with the title.

This closing cost only applies if you’re buying a house in a flood zone or you. If you take out an FHA loan, you’ll need to pay a mortgage insurance premium upfront at closing. They also do some basic safety checking to make sure the property is move-in ready.

Your approval amount will give you an idea of the closing costs you’ll pay. Connect with a lending specialist, or learn more about programs offered by Bank of America. The interest rate does not include fees charged for the loan. Closing costs, also known as settlement costs, are the fees you pay when obtaining your loan. Closing costs are typically about 3-5% of your loan amount and are usually paid at closing.

Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. As the buyer, you get to choose which mortgage company you want to work with.

Comments

Post a Comment